A new credit card is launching, and it’s breaking all the rules! The X1 Card offers consumers the chance to get a credit limit based on their income, not their credit score. The card’s benefits, many of which are impressive in its own lane, could make it a great option for high-income young entrepreneurs and professionals who dont have a long credit history.

Get on the waitlist here!

KEY TAKEAWAYS

- The X1 Card will offer credit limits up to 5 times those on traditional credit cards, based on your income.

- It also uses just a soft inquiry when you apply, which won’t affect your credit score.

- Its rewards rate is hard to beat, but redemption options are limited.

- The card is light on fees and carries a below-average interest rate.

What You Need to Know About the X1 Card

Regardless of what your credit score looks like, the X1 Card offers some standout benefits and features, which could easily make it a top-of-wallet card. Here’s what you need to know.

Focuses More on Income Than Credit

X1’s issuing bank will run a credit check when you apply, but it won’t be a hard inquiry like the ones most card issuers perform, so it won’t take points off your credit score.

If you do need help with improving your credit score,

check out these tips: jerrygoins.com/credit

If you’re approved for the X1 Card, your credit limit will be based on your income instead of your creditworthiness, and it’ll be up to five times what traditional cards might offer you. What’s more, you’ll get automatic credit line increases as your income goes up.

This means that if you haven’t had the chance to build credit or you’ve made some minor missteps in the past, you won’t be punished with a tiny credit limit.

Offers Impressive Rewards Rates and Features

Everyone who qualifies for the X1 Card will earn a flat 2 points per dollar on every purchase they make. If you spend more than $15,000 in a year, though, you’ll get a bump to 3 points for every dollar you spend during the year. Refer a friend, and for each one who gets the card, you’ll earn 4 points per dollar for 30 days.

The gold standard right now for flat-rate rewards cards with no annual fee is a 2% rewards rate, so even if you never earn the bonus rates, you’ll be doing well.

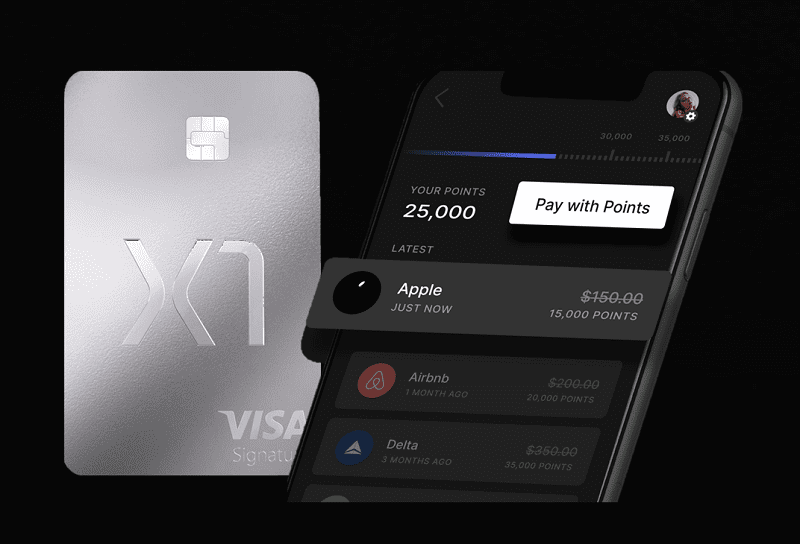

The only drawback is what you can do with those points, which isn’t a lot compared with some competing cards. Essentially, you can redeem your rewards for statement credits against purchases from 40-some retailers, including Airbnb, Etsy, Nike, and Wayfair. Points are worth a minimum of 1 cent apiece but can be worth up to 2 cents each with some retailers.

Other features include:

- Auto-expiring virtual cards you can use for free trials

- One-time use virtual cards you can use to prevent identity theft

- The ability to cancel subscription payments with just one click

- The option to attach receipts to purchases

- Instant notifications on refunds

- Stainless steel card design

Charges Lower Interest Rates and Fees

The X1 Card’s APR can range from 12.9% to 19.9% variable, and yours will be based on your credit profile. In contrast, the median interest rate on the credit cards in the Investopedia card database is currently 19.49%.

The card also charges no annual fee, no foreign transaction fees, and no late fees. Its balance transfer fee is also a little lower than the industry standard.

Consumers should keep in mind, though, that a credit card with low fees can still cost you money with its APR. To avoid interest charges, it’s smart to pay your bill on time and in full every month.

Some Details Remain Unclear

X1 hasn’t disclosed the card’s issuing bank yet, so it’s difficult to gauge what to expect in terms of customer experience and satisfaction.

Also, while it does mention that its higher limits could help boost your credit score by reducing your credit utilization rate, it’s not clear whether the card’s issuer will report your account activity to all three national credit bureaus or just one or two of them.

The card will be available in the winter, but X1 hasn’t yet specified a date. However, if you join the waitlist on the card website, you’ll get a notification when it’s ready. You can also move up the waitlist if you share your alma mater or employer, or if you invite a friend.

The Income-Based Model Could Prove Risky

X1 calls the current credit scoring system “archaic,” but skipping it altogether with credit limit decisions could spell trouble for the company and its credit card users.

A person’s income level isn’t an indicator of how well they manage their debts, which is why it’s not included in your credit score. So it will be possible for cardholders to rack up a large balance—up to five times larger than with a traditional card—and struggle to pay it off. It could make things even more challenging if a high-income cardholder with a massive limit loses their income in a layoff.

Credit card programs have significant fixed costs and must achieve a large scale to be profitable. By adding more exposure to credit losses through higher limits and also offering an outsized rewards program, this card is betting it can make the risks pay off.