Working 40 hours a week for 40 years to retire off of 40% of your income is an outdated idea of the industrial age. There is no longer a thing such as “job security.” That phrase is an oxymoron. If you plan to succeed in America, you will need to own your own business! Oftentimes, the barriers of starting a business scare people away. But if I could show you a way to start one without all the usual hassle plus showed you the tax benefits of owning one, you’d probably make one of the best financial decisions of your life!

The Two Tax Codes

In America, there are basically 2 tax codes. There is a tax code for business owners and there is a tax code for employees. The tax system favors business owners much more than employees. The government offers numerous tax breaks for business owners and entrepreneurs because there are more job created by small businesses than any other entity. In fact, small business drives 70% of the economy’s growth! So the more businesses people have, the better for Uncle Sam… why not incentivize business owners? Why aren’t you one yet?

How To Qualify For Lower Taxes

Start a business with the intent to earn money, work your business at least 2-3 hours per week and record your business activity (income, expenses and mileage) to qualify. Did you know that millions of people who join network marketing are just taking advantage of the incredible tax benefits? As an independent business owner of these programs, the government allows them to deduct expenses like a CEO would. If you would like my recommendation for an easy, long-term, home-based biz, continue reading…

How Deductions Work

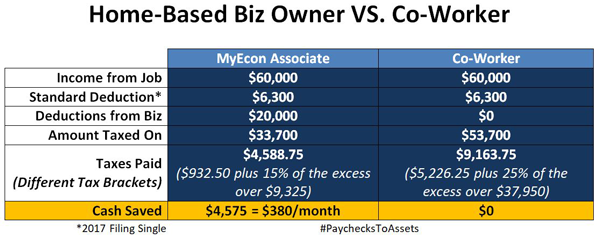

Tax deductions are not cash but they lower your taxable income. The more tax deductions you have the bigger cash value they have. The spreadsheet below gives an example of how this works.

In the example above, both individuals made $60,000 in income for the year and take the standard $6,300 deduction. The only difference is the home-based business owner was able to write off $20,000 worth of mileage, rent, cell phone bills, meals and entertainment. This reduced their taxable income to the 15% bracket and saved $4,500 while their co-worker was still taxed at the 25% bracket and overpaid.

My Recommendations

Start with a company that will not only educate you about wealth creation but gives you an opportunity to get it as well. Text “cashflow” to 910-367-525Eight to lock arms with me. I have helped dozens of individuals legally reduce their tax liability and increase their monthly cash-flow. The ball is in your court… be the next to score! Click here to get more info.

Standing by,

J.G.

PS. Subscribe for more updates!